PUNJAB GST BILL 2023; A BIG GIFT TO SMALL TRADERS, WILL BRING MAJOR CHANGES

Chandigarh :

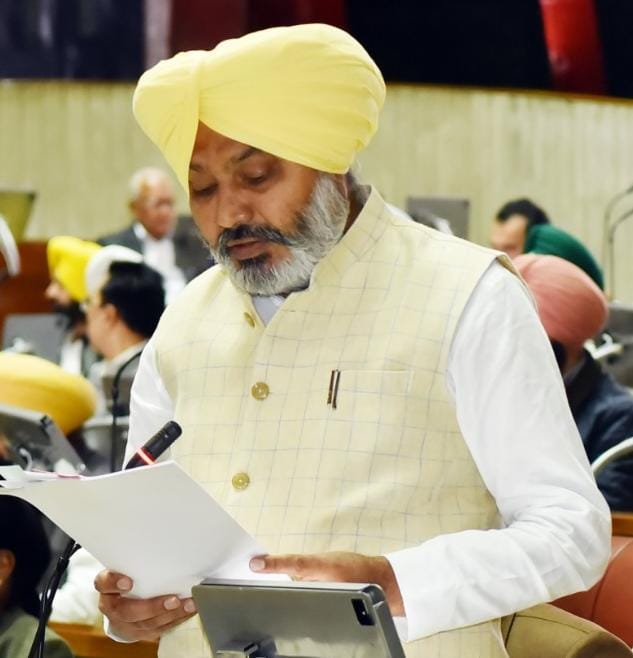

Punjab Finance, Planning, Excise and Taxation Minister Advocate Harpal Singh Cheema on Friday said that the amendments in the Punjab GST Act, 2017 through Punjab Goods and Services Tax (Amendment) Bill, 2023 are aimed at ease of doing business and simplification of tax regime.

Disclosing this in a press communiqué issued here, Finance Minister Harpal Singh Cheema said that the amendments will allow the composition taxpayers to supply goods through electronic commerce operators which will enable small taxpayers to supply their goods through e-commerce operators resulting in greater market access to them. Earlier composition taxpayers were ineligible to supply their goods through online platform, he said.

“The condition of mandatory registration of suppliers supplying goods through ecommerce operators’ up to threshold limit for registration has been removed”, said the Finance Minister while adding that this will enable small taxpayers who were otherwise bereft of access to online retail platforms to outreach greater market and consumer base.

Highlighting the constitution of State benches of the Goods and Services Tax Appellate Tribunal, Cheema said that this will provide an appellate forum to the taxpayers and will reduce the burden of higher courts. He said that the State has proposed to set up 02 State benches in order to cater to the needs of the taxpayers, which will provide timely justice and financial relief to the taxpayers.

Cheema said that certain offences i.e. destruction of material evidence, failure to supply any information/supplying false information etc. have been decriminalized and the monetary threshold for launching prosecution for the offences, except for the offences related to issuance of invoices without supply of goods or services has been increased from one crore rupees to two crore rupees. He said that this measure is aimed at augmenting the trust in taxpayers and rationalizing the gravity of offences.

Describing provisions related to online money gaming being aimed to provide for greater revenue resources for the state, Punjab Finance Minister said that it will empower the state government to tax online money gaming. He said that the compulsory registration of suppliers of online money gaming will further expand the revenue base of the State.

Reiterating the Chief Minister Bhagwant Singh Mann Led Punjab Government’s the commitment of strengthening the state economically, Finance Minister Harpal Singh Cheema said that the interests of honest taxpayers will be protected by making the tax system more transparent and easier, besides increasing the revenue for the welfare of the people of the state.